Are you looking to unlock the full potential of your Paytm Postpaid credit limit? In today's fast-paced world, having access to a higher credit limit can make all the difference. Whether you want to make bigger purchases, pay bills, or simply have a safety net for unexpected expenses, increasing your credit limit can provide the financial freedom you need.

But how can you go about doing it? In this article, we will explore five proven ways to boost your Paytm Postpaid credit limit and take control of your financial future. From maintaining a good repayment history to utilizing your credit responsibly, we'll provide you with actionable tips to help you unlock the full potential of your Paytm Postpaid credit limit. So, if you're ready to take charge of your finances and enjoy the benefits of a higher credit limit, read on to discover how you can make it happen.

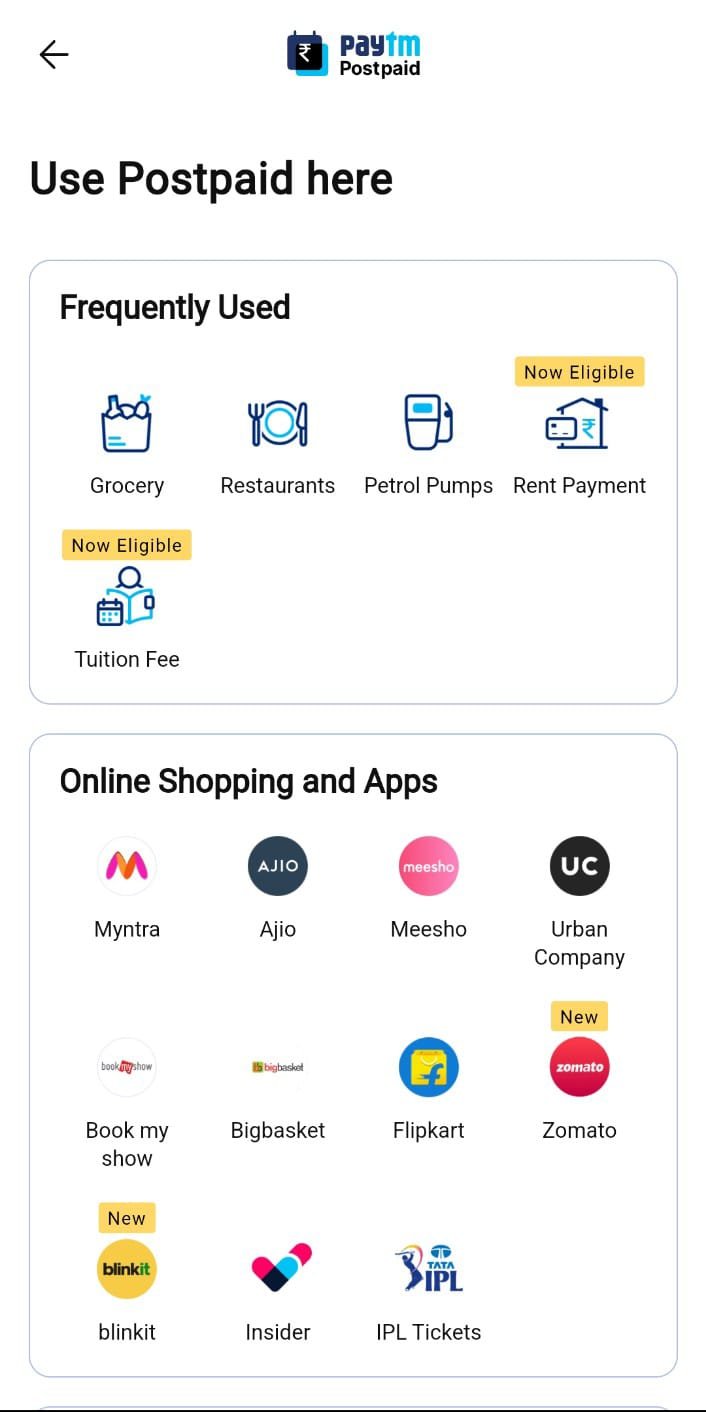

Before we dive into the ways to increase your Paytm Postpaid credit limit, let's first understand what it is and how it works. Paytm Postpaid is a credit service offered by Paytm that allows eligible users to make purchases and pay later.

Your credit limit is the maximum amount of credit that Paytm provides you, which you can use for various transactions within the Paytm ecosystem. It is important to note that your credit limit is not a fixed amount and can be increased based on your repayment behavior and other factors, as we will discuss in the following sections.

To unlock the full potential of your Paytm Postpaid credit limit, it is crucial to have a clear understanding of how it works and how it can benefit you. With this knowledge, you will be better equipped to make informed decisions and take the necessary steps to increase your credit limit.

Having a higher credit limit on your Paytm Postpaid account comes with several advantages. Firstly, it provides you with increased purchasing power, allowing you to make larger transactions and buy items that may have been previously out of reach. Whether it's a new gadget, home appliances, or even booking Bus tickets via Paytm, a higher credit limit gives you the flexibility to make these purchases without straining your finances.

Secondly, a higher credit limit can be a valuable safety net for unexpected expenses or emergencies. Life is full of surprises, and having access to a larger credit limit can provide you with the peace of mind that you can handle unexpected financial burdens, such as medical bills or car repairs, without having to dip into your savings or rely on high-interest loans.

Lastly, increasing your Paytm Postpaid credit limit also helps improve your overall creditworthiness. Lenders and financial institutions take into account your credit utilization ratio, which is the amount of credit you are using compared to your available credit limit. By having a higher credit limit and keeping your credit utilization low, you demonstrate responsible credit management, which can positively impact your credit score and open doors to better financial opportunities in the future.

Now that we understand the benefits of increasing your Paytm Postpaid credit limit, let's explore the eligibility criteria for a credit limit increase. Paytm has certain requirements that users must meet to be eligible for a higher credit limit. These criteria include:

1. Repayment history: Paytm evaluates your repayment behavior to determine if you are eligible for a credit limit increase. It is essential to make timely repayments on your Paytm Postpaid dues and avoid any defaults or late payments.

2. Credit score: Your credit score is a crucial factor that Paytm considers when deciding on a credit limit increase. A higher credit score indicates good creditworthiness and responsible financial behavior. Maintaining a healthy credit score by paying your bills and EMIs on time and managing your debts effectively can significantly improve your chances of getting a higher credit limit.

3. Financial stability: Paytm also takes into account your overall financial stability, including your income, employment status, and other financial commitments. A stable income and a low debt-to-income ratio can demonstrate your ability to manage higher credit limits effectively.

4. Usage of Paytm services: Regularly using Paytm services, such as making transactions, paying bills, and availing offers, can also contribute to your credit limit increase eligibility. Paytm values active users who utilize its services frequently and responsibly.

5. Request for credit limit increase: In some cases, Paytm allows users to request a credit limit increase manually. This option is available if you believe that you meet the eligibility criteria and have a justified reason for a higher credit limit. However, note that Paytm will still evaluate your repayment history, credit score, and financial stability before approving your request.

By understanding these eligibility criteria, you can assess your own financial situation and determine if you meet the requirements for a credit limit increase. If you do, it's time to explore the proven ways to boost your Paytm Postpaid credit limit.

1. Pay your bills on time

One of the most crucial factors in increasing your Paytm Postpaid credit limit is maintaining a good repayment history. Paytm values users who make timely payments and fulfill their financial commitments. By paying your bills on time, you demonstrate your creditworthiness and responsibility, increasing your chances of a credit limit increase. Set reminders or automate your payments to ensure you never miss a due date.

2. Maintain a good credit score

Your credit score plays a significant role in determining your creditworthiness and eligibility for a credit limit increase. To maintain a good credit score, make sure to pay all your bills, loans, and credit card dues on time. Keep your credit utilization ratio low by using only a portion of your available credit. Regularly check your credit report for errors and take steps to resolve any issues that may negatively impact your score.

3. Increase your overall financial stability

Paytm considers your financial stability when evaluating your credit limit increase eligibility. Take steps to improve your financial situation by increasing your income, reducing your debts, and managing your expenses effectively. Demonstrating stability and responsible financial behavior can increase your chances of getting a higher credit limit.

4. Use Paytm services frequently

Regularly using Paytm services, such as making transactions, paying bills, and availing offers, can show your active engagement with the platform. Paytm values loyal and active users and may reward them with a credit limit increase. So, make it a habit to use Paytm for your daily transactions and explore the various services it offers.

5. Request a credit limit increase

If you believe that you meet the eligibility criteria and deserve a higher credit limit, you can request a credit limit increase from Paytm. This option is available in the Paytm app, and you can provide additional information to support your request. While there is no guarantee that your request will be approved, it is worth trying if you have valid reasons and meet the necessary requirements.

By following these proven ways, you can increase your chances of unlocking the full potential of your Paytm Postpaid credit limit. However, it is essential to avoid common mistakes that could hinder your progress.

Common mistakes to avoid when trying to increase your Paytm Postpaid credit limit

While you focus on increasing your Paytm Postpaid credit limit, it's crucial to avoid common mistakes that could negatively impact your efforts. Here are some mistakes to watch out for:

1. Late payments: Making late payments or defaulting on your Paytm Postpaid dues can severely affect your creditworthiness and reduce your chances of a credit limit increase. Always prioritize your bill payments and ensure they are made on time.

2. Maxing out your credit limit: Utilizing your entire credit limit or keeping a high credit utilization ratio can signal financial instability and may discourage Paytm from increasing your credit limit. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management.

3. Applying for multiple credit limit increases: While Paytm allows users to request a credit limit increase, avoid making multiple requests within a short period. These frequent requests can raise red flags and may negatively impact your creditworthiness.

4. Ignoring your credit score: Your credit score is a crucial factor in determining your eligibility for a credit limit increase. Neglecting your credit score and failing to address any issues can hinder your progress. Regularly monitor your credit score and take the necessary steps to improve it.

5. Not utilizing Paytm services: Paytm rewards users who actively engage with its services. If you have a Paytm Postpaid credit limit, make it a habit to use Paytm for your transactions and explore the various services it offers. This will not only increase your chances of a credit limit increase but also help you make the most of the platform.

By avoiding these common mistakes, you can stay on the right track and maximize your chances of increasing your Paytm Postpaid credit limit.

1. Is there a specific time frame to request a credit limit increase?

Paytm allows users to request a credit limit increase at any time. However, it is advisable to wait for at least six months of regular usage and timely repayments before making a request. This allows Paytm to assess your repayment behavior and creditworthiness better.

2. How long does it take for a credit limit increase request to be processed?

The processing time for a credit limit increase request can vary. Paytm reviews each request individually, considering factors such as repayment history, credit score, and financial stability. Generally, it may take a few days to a couple of weeks for the request to be processed.

3. Can I request a credit limit increase if I have a low credit score?

While a low credit score can make it more challenging to get a credit limit increase, it is not impossible. Paytm considers various factors, including your repayment behavior and overall financial stability. If you have improved your credit score and meet other eligibility criteria, you can still request a credit limit increase.

4. Will a credit limit increase have an impact on my credit score?

A credit limit increase itself does not directly impact your credit score. However, it can indirectly affect your credit score by improving your credit utilization ratio and demonstrating responsible credit management. A higher credit limit can also provide you with more financial flexibility to handle emergencies and unexpected expenses.

5. Can Paytm decrease my credit limit?

Paytm reserves the right to decrease your credit limit based on your repayment behavior, creditworthiness, and other factors. It is essential to maintain a good repayment history and use your credit responsibly to avoid any reduction in your credit limit.

There are a few ways to increase your Paytm Postpaid limit.-

You can request a limit increase through the Paytm app or website. To do this, follow these steps:

Paytm will review your request and may approve it or decline it. If your request is approved, your new limit will be reflected in your account within a few days.

Here are some additional things to keep in mind:

The deadline to pay your Paytm Postpaid bill is the 7th of the following month. If you fail to pay your bill on time, you may be charged a late fee.

Conclusion

Increasing your Paytm Postpaid credit limit is a valuable step toward financial freedom and flexibility. By understanding the eligibility criteria, following the proven ways to boost your credit limit, and avoiding common mistakes, you can unlock the full potential of your Paytm Postpaid account.

Remember to maintain a good repayment history, manage your credit responsibly, and utilize Paytm services frequently to improve your chances of a credit limit increase. With a higher credit limit, you can enjoy the benefits of increased purchasing power, a safety net for unexpected expenses, and improved creditworthiness. Take charge of your finances today and unlock the potential of your Paytm Postpaid credit limit.